After the festive rush, India’s electric scooter market saw a correction in November 2025, with total sales dropping to 1,12,731 units. This marked a 19% decline from October’s 1,39,903 units, though year-on-year growth remained healthy at 10%. The latest figures also reveal a shake-up at the top, as established brands reclaim leading positions while some previous front-runners face steep declines.

Market Leaders Reshuffle

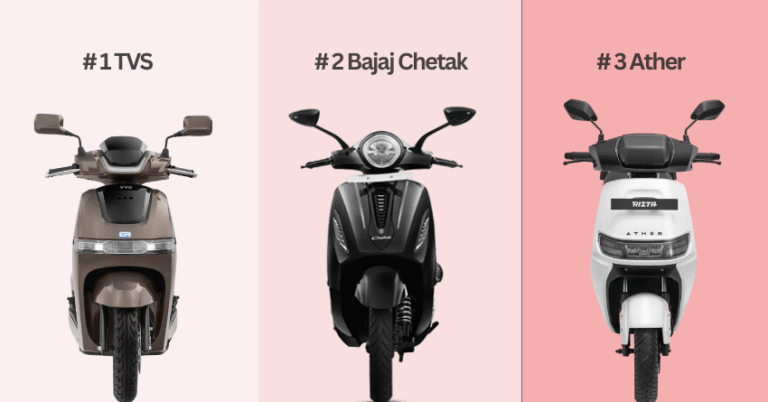

TVS iQube Electric has taken back the number one position. Many competitors saw falling sales, but TVS actually grew by 2%, moving 29,921 units in November as against 29,330 in October. The company now holds 28.2% of the market.

Bajaj Auto, which had led the market in October, slipped to the second spot. The company managed to sell 24,513 units with a 19% decline over the previous month. Bajaj still retains a strong market share of 23.1%.

Ather Energy remained third. Following the huge festive spike in October, sales returned to normal at 19,694 units, which was down 28% on a month-to-month basis. Ather now has an 18.5% share of the market.

Ola Sales Crash

The most important change in the ranking is that Ola Electric has dropped to fifth position. The car-maker published the numbers revealing only 8,149 units sold, which is a huge drop of 48% from October. This is the lowest sales volume for the brand in the last three years and is caused by the increase in service problems and regulatory hurdles.

Ola’s market share has thus fallen to 7.7%. As a result of this shift, Hero Vida moved up to fourth place. Hero’s sales were also going down by 24% exactly according to the overall market trend, but they managed to sell 11,985 units, which gave them 11.3% market share.

Bottom Five Rankings

- Greaves Electric (Ampere) held steady at the sixth position with 5,467 units sold, a 24% drop from the previous month.

- BGauss stood at the seventh position, with 2,440 units sold. This is a 14% drop, creating a market share of 2.3%.

- River Mobility was a rare gainer, moving up to the eighth position. The brand had a 10% growth, selling 1,797 units, driven by expansion in North India, besides sales of the Gen 3 scooters.

- Kinetic Green also saw positive momentum, rising to the ninth spot with 1,259 units sold, a 17% increase aided by new deliveries.

- Pure EV dropped to the tenth position. Sales fell by 37% to 1,064 units amidst management changes.

Sales Data Table

| Rank | Brand | Nov Sales (Units) | Oct Sales (Units) | MoM Change | Market Share |

| 1 | TVS iQube | 29,921 | 29,330 | +2% | 28.2% |

| 2 | Bajaj Auto | 24,513 | 30,139 | -19% | 23.1% |

| 3 | Ather Energy | 19,694 | 27,416 | -28% | 18.5% |

| 4 | Hero Vida | 11,985 | 15,685 | -24% | 11.3% |

| 5 | Ola Electric | 8,149 | 15,734 | -48% | 7.7% |

| 6 | Greaves (Ampere) | 5,467 | 7,198 | -24% | 5.1% |

| 7 | BGauss | 2,440 | 2,837 | -14% | 2.3% |

| 8 | River Mobility | 1,797 | 1,634 | +10% | 1.7% |

| 9 | Kinetic Green | 1,259 | 1,080 | +17% | 1.2% |

| 10 | Pure EV | 1,064 | 1,691 | -37% | 1.0% |