Ola Electric, once the fastest-growing name in India’s EV scooter segment, is now grappling with serious financial pressure. The company is struggling to raise fresh equity or secure new debt as declining sales, shrinking market share, and worsening cash flow have made investors increasingly cautious.

Sales and Market Slump

The current quarterly results from Ola Electric have revealed increasing financial strain. The company has reported a major drop in both revenue and sales volumes, leading to negative operating cash flows. The company has stated this as the major cause for the investors’ precaution.

| Metric | Decline |

| Quarterly Revenue | Fell 43% |

| Quarterly Sales | Plunged 47% |

| Market Share (October) | Dropped to 11.5% (from approx. 30% a year earlier) |

Funding Roadblocks

Ola’s funding outlook is negatively impacted by competing stages of financing. It is reported that many equity investors have rejected a ₹1,500-crore equity raising proposal for the company. Additionally, lenders are questioning a separate ₹1,700 crore debt proposal that was already approved by Ola’s board in May. Analysts have cautioned that unless the core volume issues are addressed, the company could face a full-scale crisis.

Debt Concerns Rising

Financial analysts have been expressing concern that Ola’s debt obligations are expected to skyrocket in the next couple of years, complicating its already difficult financial situation. Cash reserves of the company have also substantially depleted since the end of the last fiscal year.

| Financial Indicator | Amount |

| Net Cash (as of March) | ₹4,800 crore |

| Net Cash (Latest) | ₹1,600 crore |

| Projected Debt (March 2026) | ₹5,500 crore |

New Business Focus

In an effort to rekindle growth, Founder and Chairman Bhavish Aggarwal is shifting focus to the energy sector, particularly home battery storage. The company has recently launched the Ola Shakti brand of lithium-ion backup power systems, priced at approximately ₹1.2–1.25 lakh, targeting households and small enterprises. Management anticipates this new vertical will generate revenue of up to ₹1,000 crore by FY27.

Intense Market Fight

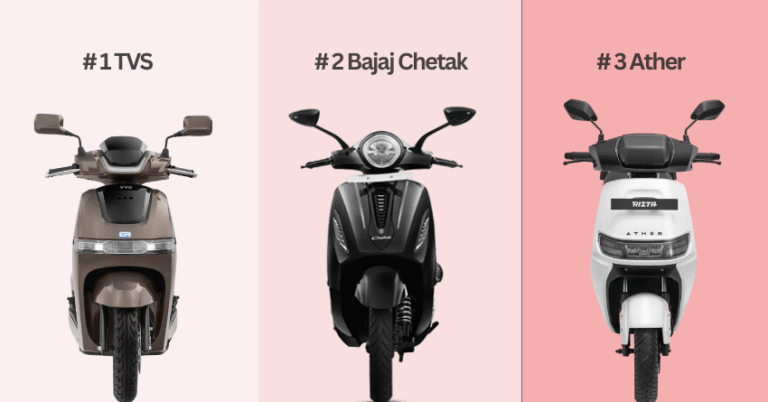

The challenges faced by Ola Electric are worsened by increasing competition from well-established players. Rival companies such as Bajaj Auto, TVS Motor, Hero MotoCorp, and Ather Energy are undertaking extensive expansion of their EV offerings and distribution networks. Analysts warn that although there is potential in the home battery market, the core automotive business “must fire on all cylinders,” which seems difficult given the current sales flow and market share.