EV scooter sales touched 1.04 lakh units in September 2025. Bajaj Chetak surged 71% to take second place, Ola slipped to fourth, while TVS iQube held the lead.

India’s E2W market posted a marginal increase in September 2025, but the ranking order was significantly displaced. The headline is certainly about Bajaj’s spectacular comeback and a big plunge for its key rival, Ola Electric. Total EV scooters sold in September were 1,04,056 units, marking a marginal gain of 3% compared to 1,01,391 units sold in August. The sector shows signs of sustained growth with its 12% year-on-year (YoY) increase.

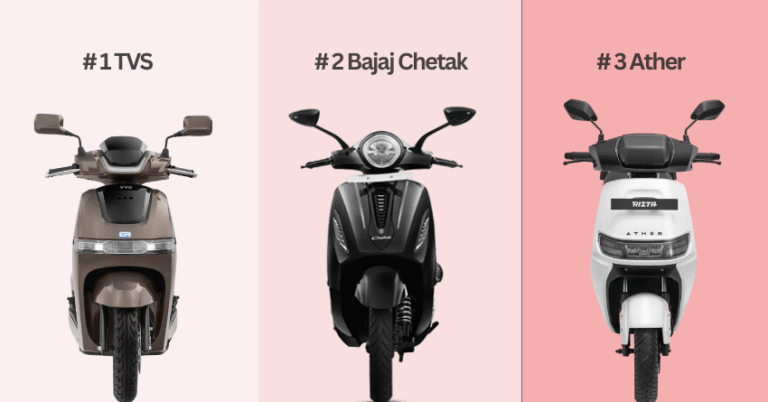

TVS iQube Retains No.1 Spot

Retaining its top position, the TVS iQube topped the sales charts in September with 22,481 units sold. This reflects a 6% month-over-month decline from August’s 24,019 units sold. Nevertheless, the iQube still holds the largest market share at 23%. The brand’s performance is expected to gain momentum during the upcoming festive season, particularly following the launch of the Orbitor in August, which may drive stronger demand in the coming months.r in August, which may drive stronger demand in the coming months.

Bajaj Chetak Climbs to 2nd, Ola Drops to 4th

Bajaj Chetak really stole the show for the month:

- Bajaj Chetak (No. 2): Bajaj’s sales saw an incredible 71% MoM jump to 19,519 units (from 11,447 in August), surging back to No. 2 after its production and delivery were delayed due to a shortage of rare earth magnets. This comeback also translates to a 20% market share for the brand.

- Ola Electric (No. 4): With sales dropping a sharp -29% MoM to 18,695 units (from 18,709), Ola Electric has lost its No. 2 standing it held since the launch hype of its S1 Pro Sport and now stands 4th in the race.

Ather, BGauss Grow

Moving to the fiercely contested middle segment, Ather Energy remained number three, selling 13,371 units and capturing 19% of market share, with a slight decrease of -4% MoM. The company had recently held its Community Day, during which it announced new vehicles such as the Rizta and Apex. Meanwhile, BGauss recorded the second-highest growth among all brands; its ranking rose to number 7 with a 37% MoM rise in sales to 2,270 from 1,656.

Top 10 Scooter Sales: September 2025

| Rank (Sept) | Brand | Units Sold (Sept) | MoM Change |

| 1 | TVS iQube Electric | 22,481 | -6% |

| 2 | Bajaj Chetak | 19,519 | +71% |

| 3 | Ather Energy | 13,371 | -4% |

| 4 | Ola Electric | 18,695 | -29% |

| 5 | Hero (Vida) | 12,736 | -3% |

| 6 | Greaves Electric (Ampere) | 4,272 | +0.6% |

| 7 | BGauss | 2,270 | +37% |

| 8 | Pure EV | 1,762 | -0.1% |

| 9 | River Indie | 1,682 | -0.1% |

| 10 | Kinetic Green | 1,084 | -13% |

| Total Sales | All Brands | 1,04,056 | +2.6% MoM |

Festive Season Outlook

The September sales pattern presents a temporary cooling before the festive period. With Diwali on its way, a crop surge is expected in the market with offers from consumers and fronting of new models. Supply chain stability is announced to encourage higher volumes across the industry, with Bajaj being a testimony of the same.